The automotive industry is undergoing a transformation, and Tesla is once again at the helm, this time venturing into the insurance sector. With the introduction of Tesla Insurance, the electric vehicle giant is not just disrupting the auto industry but also making significant waves in auto insurance. This move has sparked discussions and speculations about the impact of Tesla on the insurance industry, especially concerning electric vehicle insurance and the broader implications for auto insurance disruption.

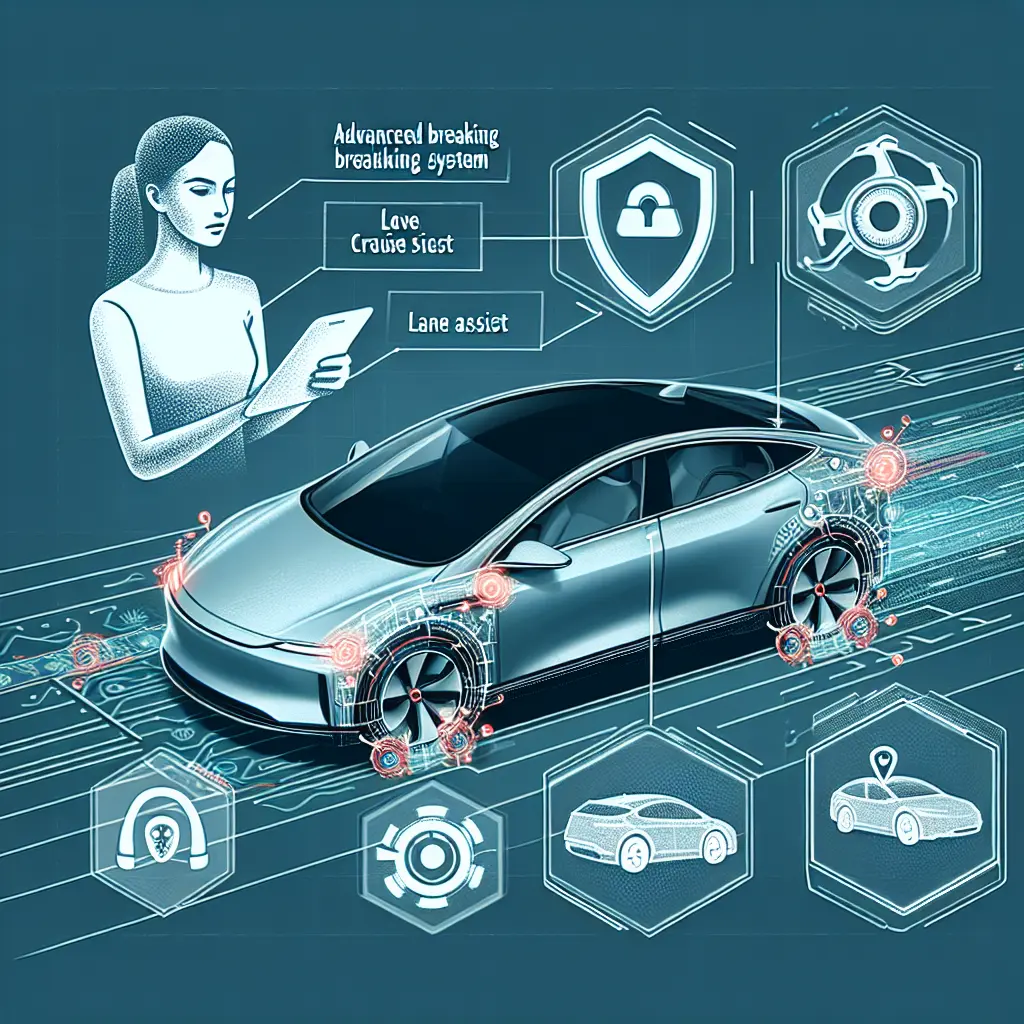

Tesla Insurance Services was launched with a promise to provide comprehensive coverage tailored specifically for Tesla's unique model specifications and their advanced safety features. Tesla’s approach integrates meticulous attention to detail in safety, which is reflected in their outstanding Tesla safety ratings. The integration of Tesla’s advanced safety features and their proactive stance on protection helps in mitigating insurance costs, which traditionally form a substantial part of vehicle ownership expenses.

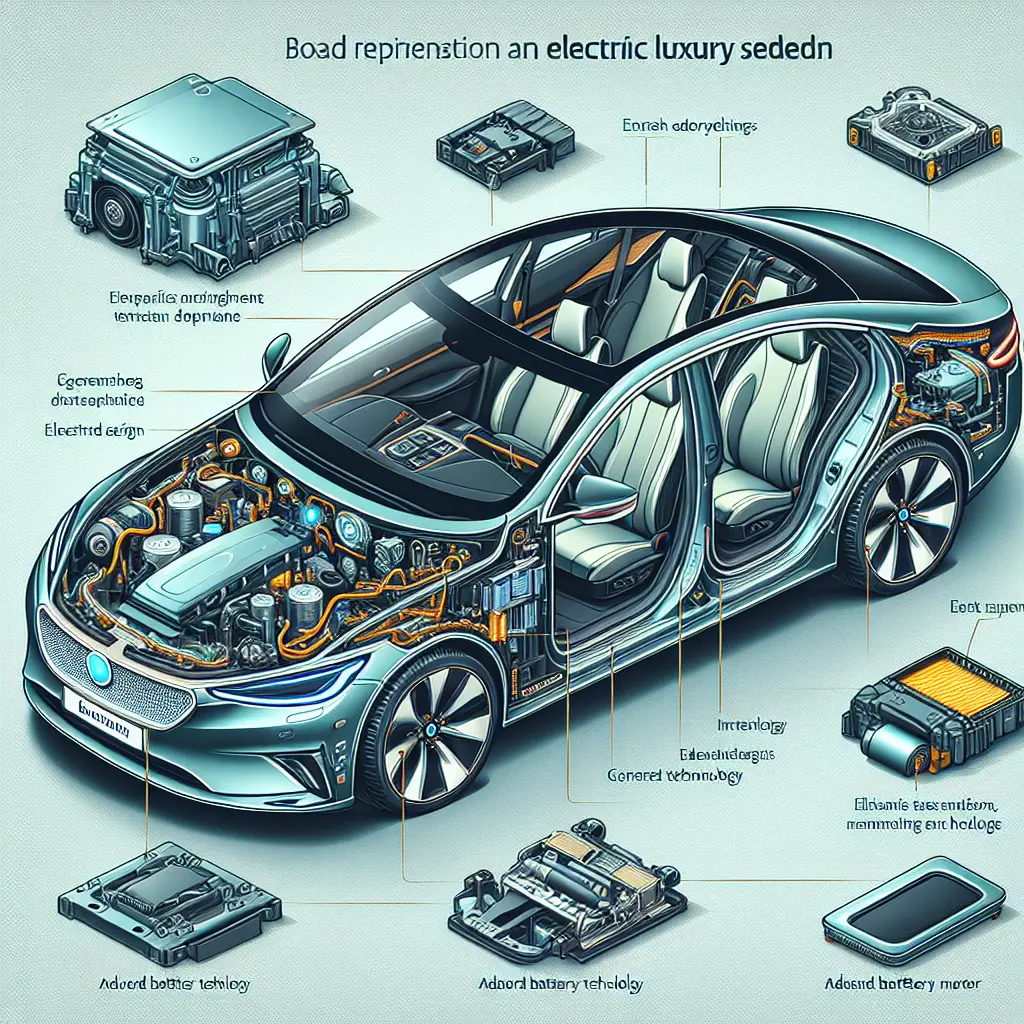

Tesla’s entry into the insurance market signifies a pivotal shift in traditional insurance models. Typically, insurance premiums for electric cars have been higher due to the perceived risk and higher costs associated with repairing advanced technology. However, Tesla is flipping this narrative by leveraging vast amounts of data from its vehicles to better understand risk - a practice at the heart of Tesla Data Analytics in Insurance. This allows for more accurate pricing models that could potentially lower insurance premiums for electric car owners, thereby encouraging more consumers to make the switch from gasoline to electric vehicles.

One of the most innovative aspects of Tesla's Insurance Model is its reliance on Tesla's Risk Assessment Technology. This system utilizes real-time driving data to assess risk more accurately than traditional models, which often depend on historical data and broad demographic information. By analyzing driving patterns and behaviors, Tesla can customize insurance policies to individual drivers, a practice that could lead to significant changes in how premiums are calculated industry-wide.

Insurance Policy Customization is another frontier where Tesla is setting new standards. Traditional auto insurance policies are often one-size-fits-all and do not consider individual driving behaviors beyond basic factors like age, location, or driving history. Tesla’s model introduces a more nuanced approach by offering customized insurance that aligns closely with personal driving habits, potentially increasing safety and reducing unnecessary costs.

Disruption Through Advanced Safety Features and Autonomous Vehicle Insurance

As Tesla continues to develop its autonomous technology, the implications for Autonomous Vehicle Insurance are profound. The advanced safety features embedded in Tesla vehicles, including Autopilot and Full Self-Driving capabilities, pose new challenges and opportunities within the insurance sector. These technologies promise to reduce accidents significantly, which could lower premiums but also require new frameworks for liability and risk assessment in autonomous driving scenarios.

Discussing the Cost of Insuring a Tesla, it's noteworthy that while initial costs may be higher due to the technology involved, the overall safety features and Tesla’s proactive risk assessment potentially lower long-term insurance costs. Moreover, as the technology becomes more mainstream and data on electric vehicles' safety becomes more robust, these costs could be adjusted further.

Tesla’s foray into insurance represents a broader trend of Innovation in Auto Insurance Sector, where data-driven decisions are becoming paramount. This shift is not just about assessing risk more accurately; it's also about enhancing customer experience and providing value that aligns with modern technological advancements in vehicles.

Tesla’s innovative approach to car insurance through its dedicated service arm, Tesla Insurance Services, marks a significant milestone in auto insurance disruption. By leveraging data analytics, focusing on safety, and customizing policies, Tesla is not just altering how drivers insure their cars; it's setting new standards for the industry at large. As we continue to monitor Tesla's influence on the market, it will be interesting to see how traditional insurance companies respond to these shifts.

Conclusion

As we navigate these exciting developments, it's clear that the road ahead will be shaped by innovation, customization, and an increased focus on data-driven decision-making. The journey has just begun, and it promises to redefine our relationship with auto insurance in an age dominated by advancements in vehicle technology.

Leave a Comment